Proven Strategies for Effectively Navigating Debt Challenges During Furlough

Proven Strategies for Effectively Navigating Debt Challenges During Furlough

The COVID-19 pandemic has created significant obstacles for the UK economy, resulting in a wave of furloughs and job losses across various industries. Consequently, numerous individuals are facing financial instability while trying to manage their existing debts amid reduced income levels. If you have been furloughed for a prolonged period, addressing your debt situation may seem overwhelming, especially since your income is now limited to 80% of your usual salary. Nevertheless, overcoming these financial hurdles is possible by adopting effective debt management and reduction strategies. Here, we outline crucial steps to help you regain control of your financial well-being during these trying times and pave the way toward a more secure financial future.

1. Create a Customized Monthly Budget Based on Your Current Financial Situation

Begin by developing a revised monthly budget that accurately reflects your current financial circumstances. This budget should capture your reduced income while focusing on your ability to save effectively. Take a moment to evaluate your spending patterns and consider reallocating funds from non-essential expenses—such as entertainment, dining out, and luxury items—towards your primary bills and savings. By prioritizing debt obligations and minimizing discretionary spending, you can establish a sustainable budget that not only aids in managing your debts more efficiently but also equips you for any potential financial challenges that may arise in the future.

2. Investigate Alternative Income Sources to Offset Salary Reductions

To meet your debt repayment obligations, it is essential to explore various avenues to compensate for the 20% salary reduction. Look for alternative income streams, such as freelance work, part-time jobs, or side hustles that align with your skills and interests. Additionally, consider cutting back on expenses by terminating subscriptions you rarely use or reassessing your grocery shopping habits. Implementing a strategic meal planning approach can lead to considerable savings. By proactively seeking ways to increase your income and decrease expenses, you can remain on track with your debt obligations and prevent falling behind during your furlough period.

3. Evaluate Debt Consolidation Loans for Simplified Payment Management

Consider applying for debt consolidation loans for bad credit. These financial solutions are designed to streamline your financial commitments by consolidating multiple debts into a single, more manageable monthly payment. This approach can reduce confusion regarding due dates and payment amounts, making it easier to plan your finances. For those on furlough, a debt consolidation loan offers a structured way to manage a limited income while alleviating the stress of juggling various payments, ultimately assisting you in restoring your financial stability.

4. Plan Strategically for Your Future Financial Objectives and Security

While navigating your current financial circumstances, it’s crucial to maintain a focus on your long-term goals, such as homeownership or starting a business. Defining these future aspirations can serve as a powerful motivator to enhance your financial situation. A <a href="https://berwicktestandtag.com.au/debt-consolidation-loan-calculator-for-smart-budgeting/">debt consolidation loan</a> can also improve your credit score, making it easier to qualify for a mortgage or business loan with favorable interest rates. By strategically planning and working toward your financial goals, you can set the stage for future success and cultivate a greater sense of financial independence over time.

For additional support and insights on managing your finances during the pandemic, and to discover how <a href=”https://limitsofstrategy.com/understanding-good-debt-and-bad-debt-a-clear-guide/”>debt consolidation loans</a> can be beneficial for furloughed employees, reach out to Debt Consolidation Loans today for expert guidance.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to find out how a debt consolidation loan can improve your financial health and stability.

If you think a Debt Consolidation Loan fits your financial objectives, don’t hesitate to get in touch or call 0333 577 5626. Take the crucial first step toward enhancing your financial situation with a single, manageable monthly repayment.

Access Essential Financial Resources for Expert Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Is It Feasible to Successfully Consolidate Your Medical Loan?

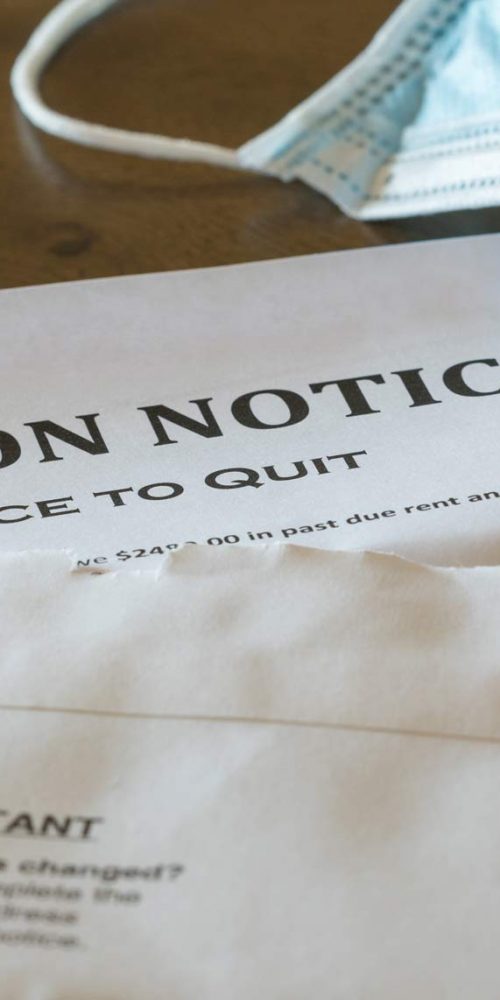

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Critical Updates on Eviction Policies Postponed Until March

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Rapid and Effective Strategies for Swift Debt Relief

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

In-Depth Analysis of the Pros and Cons of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning